Salary types

This is a PRO feature (not available in the free version).

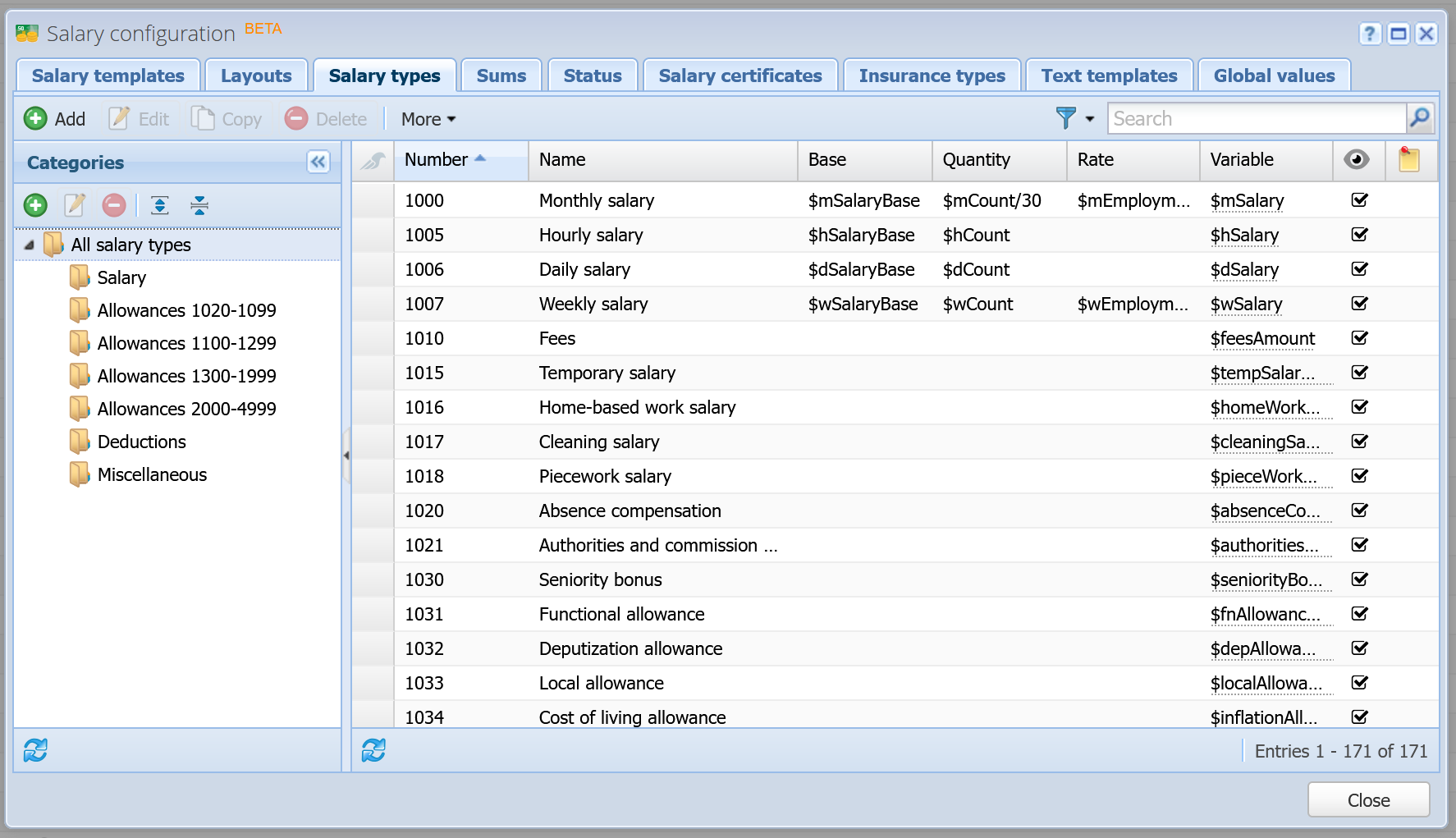

Here you manage the salary type master, with more than 160 salary types, mostly adopted from Swissdec. This is where the magic happens!

Salary types include salary (such as monthly salary and hourly salary), allowances (such as child allowances and bonuses), deductions (such as OASI contribution and OPP contribution), employer contributions, and expenses. Each row on the salary statement is a salary type, except for the bolded totals, which are called sums.

Salary types are first preconfigured in salary templates. A salary template can already contain salary types and also preconfigure their input values. Salary statements are created from salary templates and inherit their salary types.

Each salary type has a calculation formula, which calculates the result, meaning the amount, of the salary type. The calculation formula works with variables. These variables come from input fields and pre-calculation formulas, which are also configured in the salary type. Multiple fields, similar to custom fields, can be added to a salary type, as well as multiple pre-calculations. Variables from global values are used as well.

The calculation of salary types is carried out in the order of the numbers. This means that first salary type 1000 is calculated, then 1001, then 1002, and so on. Only salary types that are in the salary statement are calculated, all others are ignored. The result of a salary type is then available as a variable for later calculations. This means that the variable $mSalary from the salary type "1000 Monthly salary" is available in the calculation formulas of all following salary types, but not the other way around. Also, all variables from fields and pre-calculations are available, both in the salary type itself and in subsequent salary types.

Almost all values that are relevant for payroll accounting, meaning values such as employment level, OASI rate, UI rate, and child allowances, are entered in the fields of the salary types directly in the salary template or salary statement. Only a few values are taken from elsewhere, such as gender, date of birth, age, children of the employee, which are set in the person with the role "Employee".

The result of a salary type is displayed as an amount on the salary statement, used as an amount in the journal entries of the salary statement, and further added to or subtracted from sums, depending on the type of the salary type. This means that, for example, the monthly salary is added to various sums and bases, such as the sums gross salary, net salary, but also bases such as OASI base, OPP base, and others. The bases can then be used in the calculation of subsequent salary types, such as in the OASI contribution, where the OASI base is used. The calculation is simplified as follows: $ahvBase * $ahvRate / 100. Here, $ahvBase, meaning OASI base, is the variable of a sum, where various salary type amounts have been added. $ahvRate, meaning OASI rate, is the variable of a field that is entered directly in the salary type "OASI contribution".

The salary type master containing the obligations, meaning which salary type is added or subtracted to which sum, can be viewed in the reports.

Add / Edit / Copy [more]

Here you can create a new salary type or edit or copy an existing one. Please edit an existing salary type only if you are absolutely sure of what you are doing.

Delete

Select one or more salary types to delete them. It is recommended to set salary types as inactive instead of deleting them. Delete at your own risk!

More

Here you can export the table as PDF, Excel, or CSV.

Categories

Salary types are categorized into salary, allowances, deductions, and other. However, you can also create your own categories. Select one or more salary types to assign them to a category using drag & drop.

Add / Edit [more]

Here you can create a new category or edit an existing one.