Edit salary type

This is a PRO feature (not available in the free version).

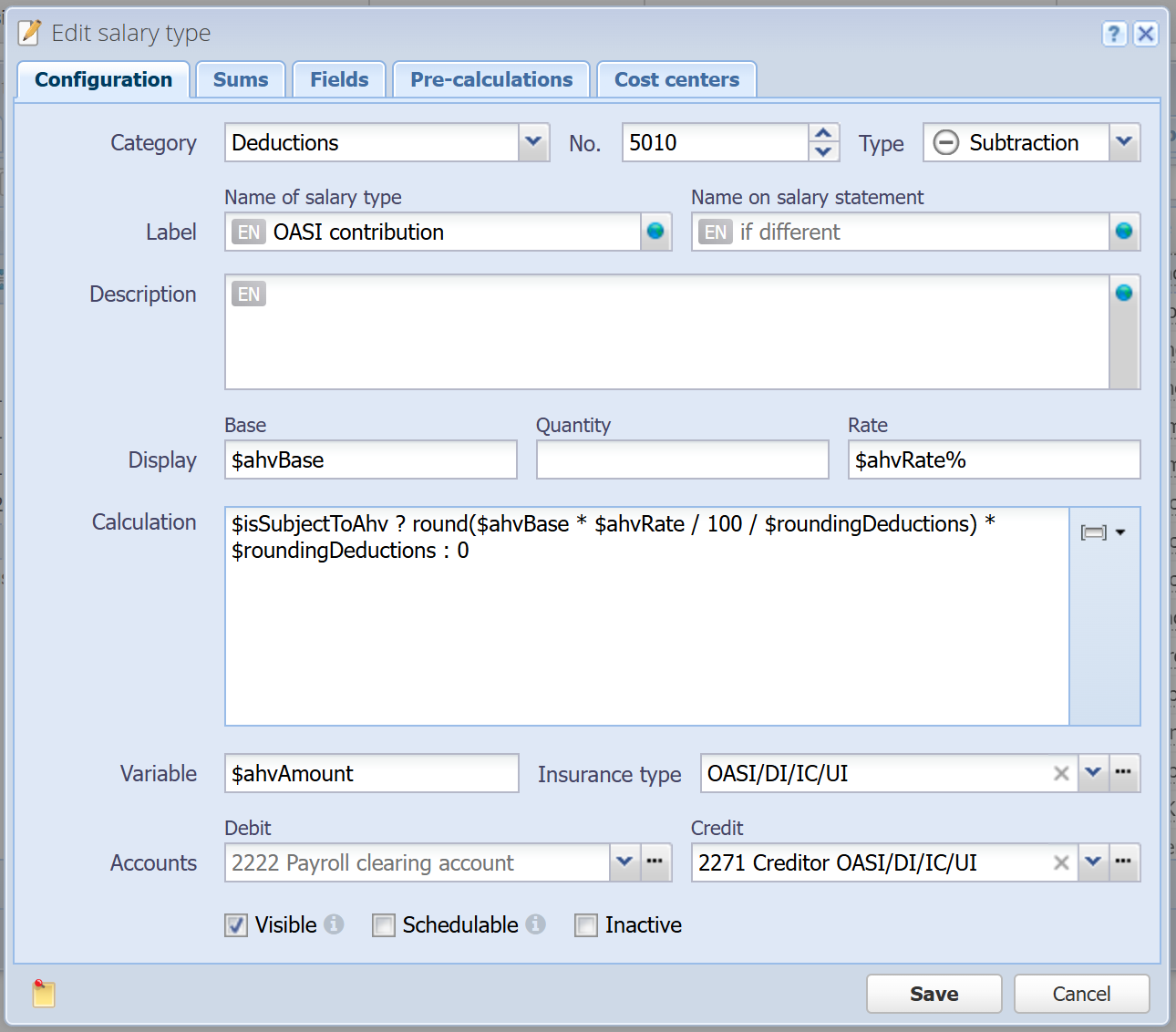

Category

Mandatory field

Select the category in which this salary type is created. Categories are only used for structuring and have no further function.

Number

Mandatory field

Enter a salary type number between 1 and 9999. The number must be unique across all salary types and sums. Salary types are calculated and displayed on the salary statement in the order of these numbers.

Type

Mandatory field

Choose between Addition and Subtraction. Salaries and allowances are typically added, while deductions are subtracted.

Name of salary type

Mandatory field

Enter the name of the salary type. This can be multilingual, see Translation field.

Name on salary statement

Mandatory field

If a different name should appear on the salary statement received by the employee, enter it here. The same variables used in the calculation can be applied. This name can be multilingual, see Translation field.

Description

Optional description that is displayed on the salary statement under the name.

Display: Base

Enter the text that should appear in the "Base" column on the salary statement. The same variables used in the calculation can be applied.

Display: Quantity

Enter the text that should appear in the "Quantity" column on the salary statement. The same variables used in the calculation can be applied.

Display: Rate

Enter the text that should appear in the "Rate" column on the salary statement. The same variables used in the calculation can be applied. Do not forget to include the % sign, as it is not added automatically.

Calculation

Mandatory field

Enter the formula that calculates the result (amount) of the salary type. This uses a restricted JavaScript engine, meaning simple mathematical formulas and limited JavaScript (if/else/return) can be used. Loops (for/while) are not allowed. In the example of the OASI contribution, the calculation includes the following variables and functions:

$isSubjectToAhv = Variable from a pre-calculation result (see Pre-calculations)

round() = A mathematical function for rounding (from the JavaScript Math Library)

$ahvBase = Variable from a sum, in this case, the OASI base sum (see Sums)

$ahvRate = Variable from a field within this salary type (see Fields)

$roundingDeductions = Variable from a global value (see Global values)

![]() Click here to look up available variables and functions and insert them at the cursor position.

Click here to look up available variables and functions and insert them at the cursor position.

Variable

Mandatory field

The variable where the result of this salary type is stored. It is available for subsequent salary types in calculations but not for preceding salary types.

Insurance type

If this salary type is present in the salary statement, a matching insurance must also be included. This requirement is enforced here. For example, the salary type "OASI contribution" requires a compensation fund/insurance of type "OASI/DI/IC/UI".

Accounts: Debit / Credit

If this salary type should be recorded in the journal, enter the debit and credit accounts here. If either debit or credit is left empty, the default payroll clearing account is used (see Default accounts). If both are empty, the salary type is not recorded in the journal. The salary statement must have a status where amounts are posted, meaning it must not be in draft status.

Visible

If checked, this salary type will appear on the salary statement (PDF document for the employee). Otherwise, it will be hidden. For example, employer contributions are typically hidden.

Schedulable

If checked, this salary type can be scheduled in the salary statement, meaning a start/end date or a specific month can be set for when it becomes active. If the conditions are not met, the salary type will not be calculated and will appear grayed out on the salary statement. It will not appear on the PDF document. This is useful for pre-entering salary types for future use.

Inactive

If checked, this salary type can no longer be added to salary templates or salary statements in the future. Existing salary templates and salary statements are not affected. This is preferred over deleting a salary type.

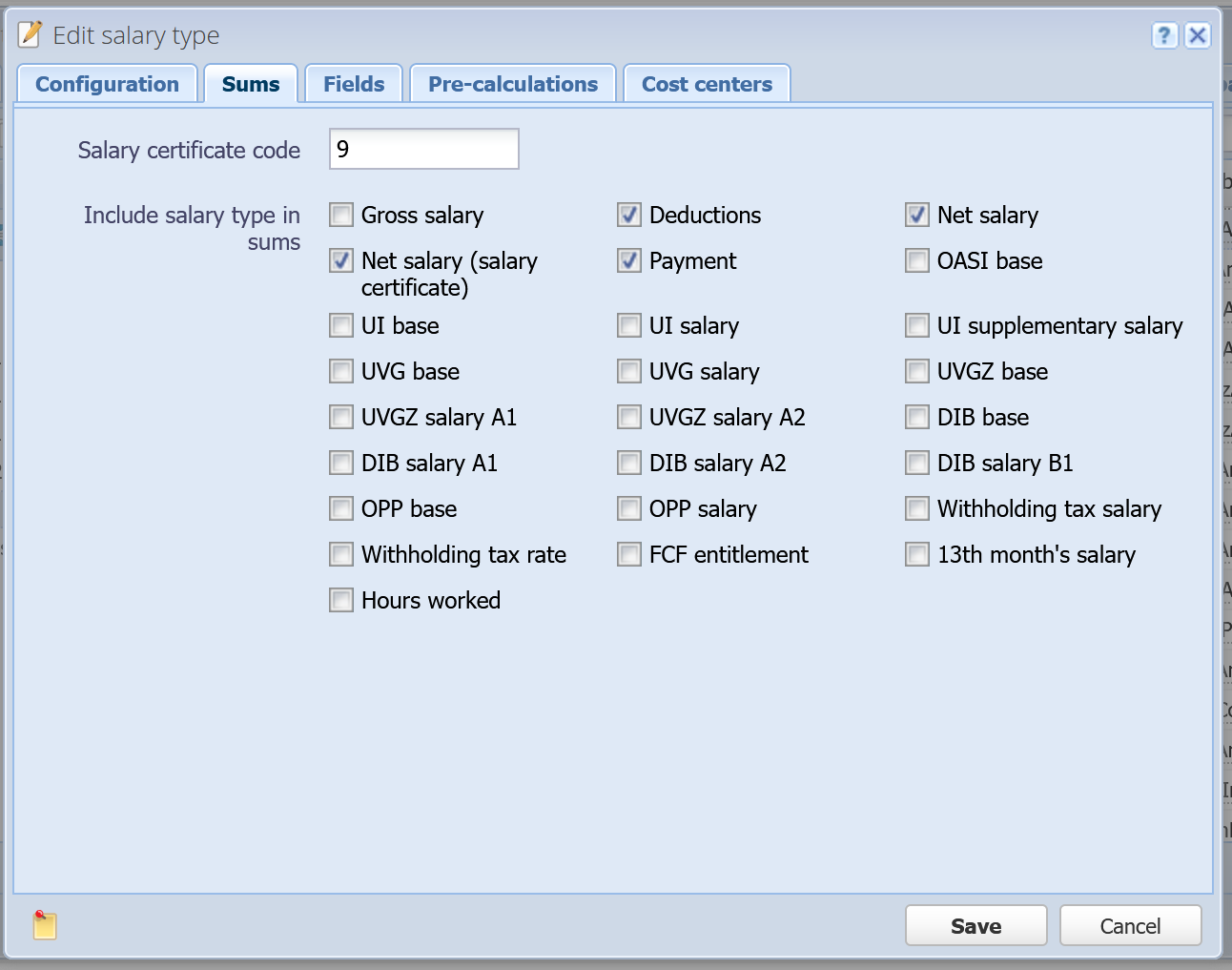

Sums

Salary certificate code

The result of the calculation is added to the sum of the salary certificate code. Each code on the salary certificate represents a sum, which starts at 0.00, similar to sums. Salary types used in salary statements are added to the corresponding code cumulatively across all salary statements in the salary period. The code corresponds to the code of an element in the salary certificate template, ensuring that totals are printed correctly on the form.

Include salary type in sums

There are sums and bases that start at 0.00 in every salary statement. Once a salary type is calculated, its result is added to or subtracted from the sums marked here. Sums such as gross salary, deductions, net salary, and payment are displayed on the salary statement document. Other sums serve as bases for calculating subsequent salary types, such as the OASI base. The salary type master report lists all salary types and their dependencies, meaning which salary type is included in which sum.

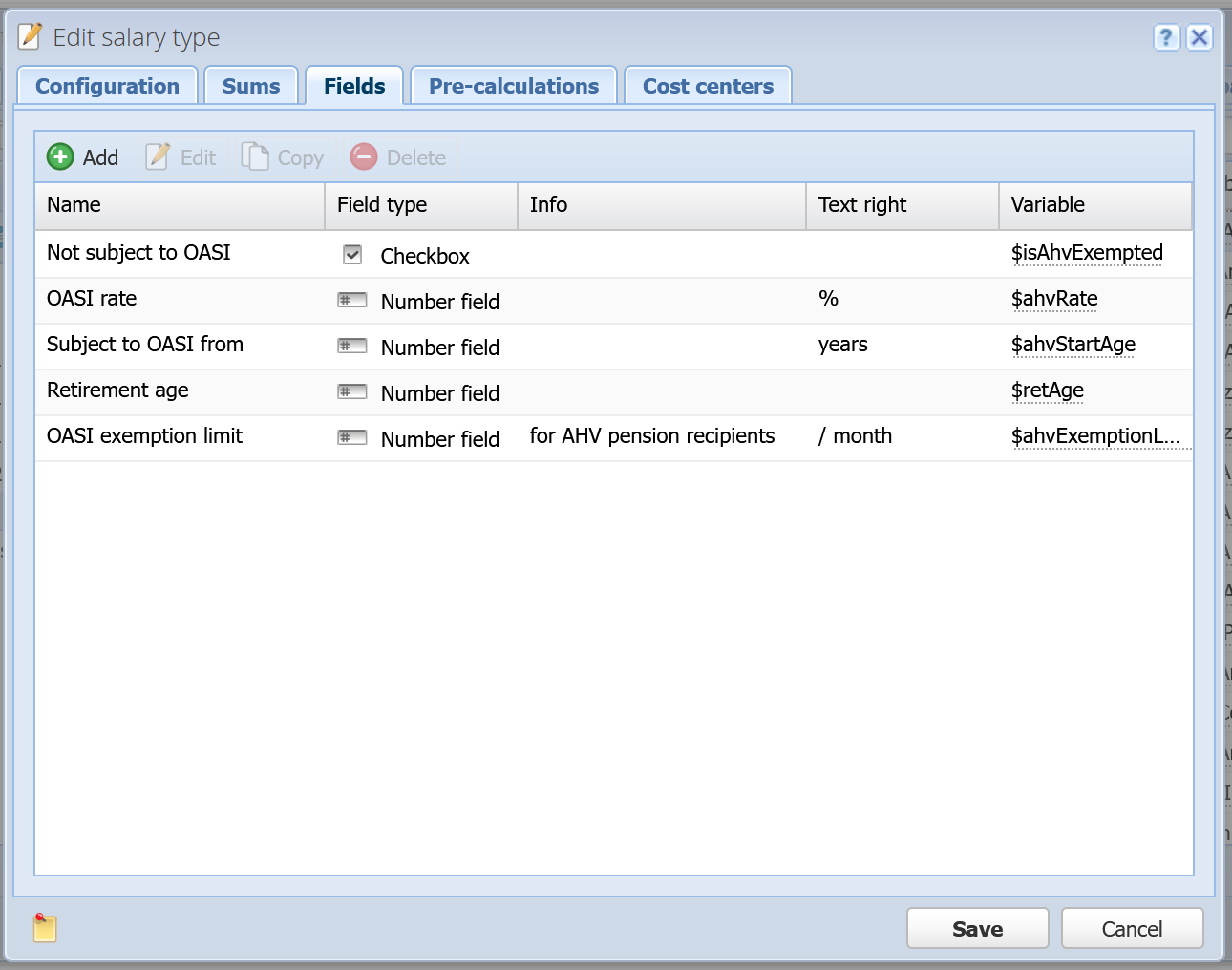

Fields

Here you can define dynamic fields for this salary type, similar to custom fields. These fields are displayed in the salary template and salary statement when adding or editing a salary type. The entered value is stored in a variable, which can be used in the calculation field of the salary type or in a pre-calculation. Subsequent salary types also have access to these variables.

Add / Edit / Copy [more]

Create a new field or edit/copy an existing one. Editing predefined fields is at your own risk!

Delete

Select one or more fields to delete. Deleting predefined fields is at your own risk!

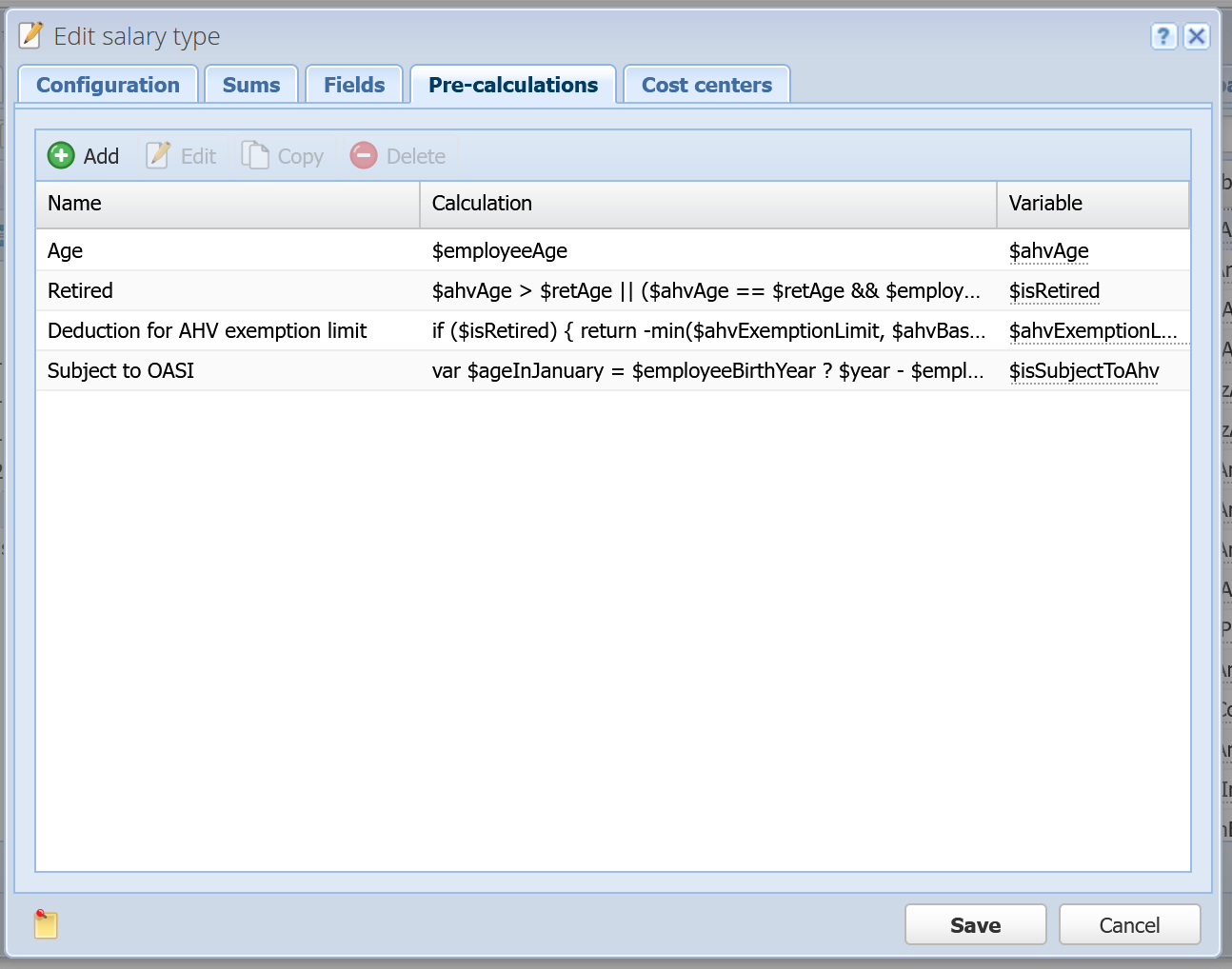

Pre-calculations

Here you can pre-calculate values that can be used as variables in the calculation field of the salary type. Subsequent pre-calculations and salary types also have access to these variables. When a salary type is calculated, the following sequence applies: All filled field values are stored. All pre-calculations are executed from top to bottom. Finally the main calculation of the salary type is performed.

A pre-calculation offers several advantages:

- The main calculation field of the salary type remains clearer and easier to read.

- Like fields, the result of a pre-calculation is displayed in a tooltip in the salary statement, making the salary type calculation more transparent.

- A pre-calculation can also add itself to sums, which is necessary, for example, for determining the correct withholding tax rate.

You may ask: Why does a pre-calculation exist with only a single variable ($employeeAge) as a calculation? This is simply to ensure that the employee's age appears in the tooltip on the salary statement (see advantage #2).

Add / Edit / Copy [more]

Create a new pre-calculation or edit/copy an existing one. Editing predefined pre-calculations is at your own risk!

Delete

Select one or more pre-calculations to delete. Deleting predefined pre-calculations is at your own risk!

Cost centers

Here you can distribute the calculated amount of the salary type across cost centers, provided that journal entries are generated from the salary statement. You can enter multiple cost centers, each with its respective share of the amount (e.g., 1:1, which corresponds to 50%:50%). Tip: The percentage value is automatically calculated from the share, but you can also directly enter the percentage value as a share — it results in the same distribution.