Complete fiscal period

If you have completed the accounting of a fiscal period you can close it to protect its entries from further changes. When completing the latest fiscal period, the next one is automatically created. Note that there is no such dialog for completing the salary period, it is completed directly.

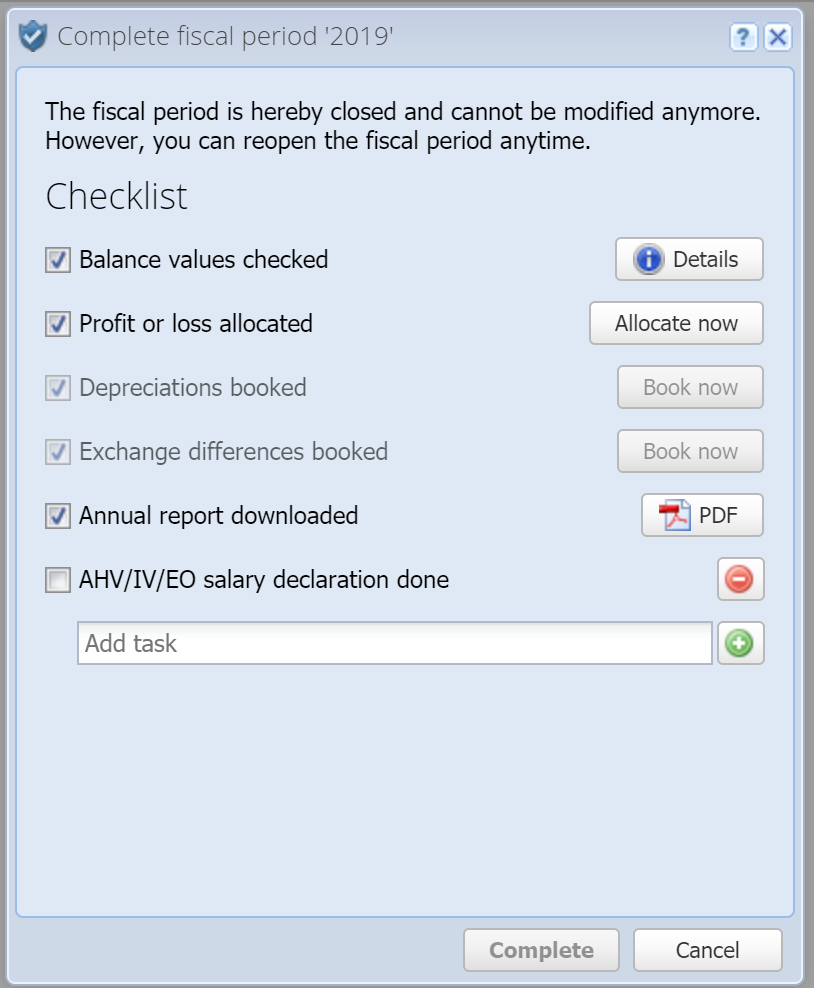

Here you'll find a checklist to confirm everything has been completed before you close the financial year.

Balance values checked

Balance values checked

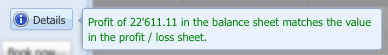

CashCtrl checks if the stated profit / loss in the balance sheet is identical to the amount in the profit & loss statement. If so, the checkbox is checked automatically, otherwise the following message appears if you click on "Details".

Profit or loss allocated

For the year-end closing you should allocate the profit or loss. This can be done right here with Allocate now.

Depreciations booked

CashCtrl books the depreciations on fixed assets semi-automatically. This means you only have to define the rates of depreciation for fixed assets, and you can let CashCtrl book the depreciations here with Book now.

Exchange differences booked

If accounts are maintained in foreign currencies the exchange differences can be booked with Book now right here.

Annual report downloaded

This next item just gives you the possibility to download the PDF here directly if you didn't already under Reports. The annual report can be adapted under Reports. It's important that you save at least the balance sheet / profit & loss statement as a PDF after completing a financial year. Better yet export all data as PDF or Excel files (see Export) and store them in a safe place so they cannot get lost or corrupted through accidental changes for sure.

Add task

Furthermore you can add your own tasks to the checklist. Just enter the description of the task in the input field "Add task" and press ENTER or click on the plus button to the right. CashCtrl remembers this checklist and displays it for the next year-end closing as well.

Complete

If all the checkboxes have been checked, the "Complete" button is enabled and you can complete the fiscal period.