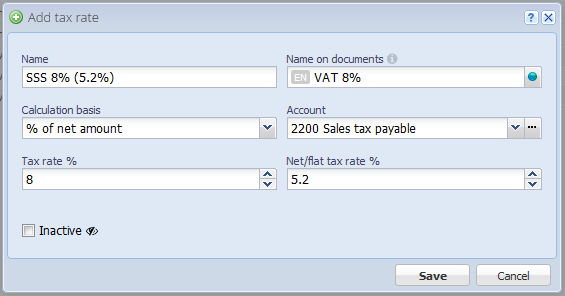

Edit tax rate

Name

Mandatory field

Internal name of the tax rate which is displayed in the select box where you choose a tax rate. It can be entered in multiple languages, see Translation field.

Name on documents

Name of the tax rate which is displayed on order documents like invoices, etc. You can enter it in multiple languages, see Translation field.

Calculation basis

Mandatory field

There are two different ways to calculate the tax amount:

% of net amount (default):

This way, the tax rate is calculated from the net amount.

Tax amount = Net amount × Tax rate ÷ 100

Example 1: Net amount is 100.00, tax rate 8%, therefore the tax amount is 8.00 and the gross amount 108.00.

Example 2: Gross amount is 100.00, tax rate 8%, therefore the tax amount is 7.41 and the net amount 92.59.

% of gross amount:

This way, the tax rate is calculated from the gross amount.

Tax amount = Gross amount × Tax rate ÷ 100

Example 1: Gross amount is 100.00, tax rate 8%, therefore the tax amount is 8.00 and the net amount 92.00.

Example 2: Net amount is 100.00, tax rate 8%, therefore the tax amount is 8.70 and the gross amount 108.70.

Account

Mandatory field

The account which collects the tax amounts from book entries.

For a value-added tax this would be e.g. "2200 Sales tax payable", for the input VAT "1170 Sales tax receivable" (depending on how your chart of accounts is set up).

Tax rate %

Mandatory field

Enter here the effective tax rate in percent.

Net/flat tax rate %

If you agreed on a net tax rate (Saldosteuersatz / SSS) resp. flat tax rate (Pauschalsteuersatz / PSS) with the taxing authority, enter it here.

Note: The configurable calculation basis (see field above) is only used for the effective tax rate, not for the net/flat tax rate. The net/flat tax amount is always calculated from the gross amount.

Inactive

If the tax rate is set to "Inactive" it is hidden in the selection box. It is, however, not deleted.

Tax rates that have already been used in book entries cannot be deleted anymore, but they can be deactivated this way.